· Steve Almeroth · 3 min read

Understanding Over-the-Counter (OTC) Allowances in Medicare Advantage

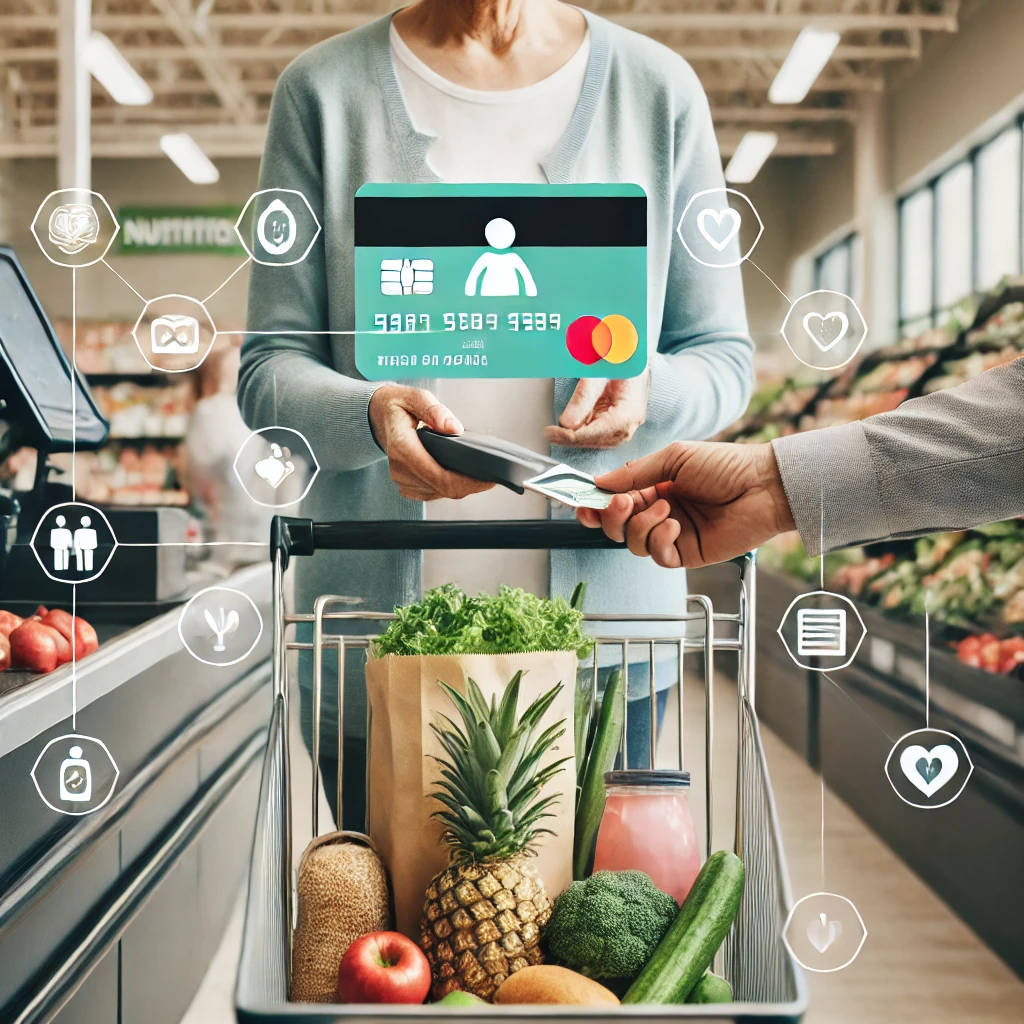

Over-the-Counter (OTC) allowances are one of the most useful benefits included in many Medicare Advantage plans.

The OTC allowance allows beneficiaries to purchase everyday healthcare products without spending their own money, making it a valuable resource for seniors who want to maintain their health while managing costs. In this blog post, we’ll dive into how OTC allowances work, what you can buy with them, and how to make the most of this benefit.

What is an OTC Allowance?

An OTC allowance is a set amount of money provided by your Medicare Advantage plan, typically on a quarterly or monthly basis. This allowance is specifically intended for the purchase of non-prescription, over-the-counter healthcare products. These may include items like vitamins, pain relievers, cold medicines, first-aid supplies, and even personal care products like toothpaste and shampoo.

The amount you receive and how often it’s replenished depends on your specific Medicare Advantage plan. Some plans may offer higher allowances for individuals with certain health conditions, while others may have more limited options. Typically, you’ll receive a catalog of eligible products or access to an online portal where you can order these products directly. Many plans also partner with specific pharmacies or retailers, allowing you to shop in-store or online.

How to Maximize Your OTC Allowance

Making the most of your OTC allowance involves understanding what’s covered, where to shop, and how to plan your purchases. Here are some tips to help you maximize this benefit:

Know What’s Covered: Your Medicare Advantage plan will provide a list or catalog of eligible products that you can purchase with your OTC allowance. Familiarize yourself with this list so you can focus on purchasing the items you need most. While the list typically includes basic health and personal care products, some plans offer additional items like home health aids or wellness products.

Use Partner Pharmacies and Retailers: Many Medicare Advantage plans partner with specific retailers where you can use your OTC allowance. Make sure you know which stores are included in your plan, whether they are brick-and-mortar locations or online options. Some plans may even offer free shipping for online orders, making it more convenient to shop from home.

Track Your Balance: It’s essential to keep track of your OTC allowance balance, especially if it’s replenished on a quarterly or monthly basis. Some plans will allow you to roll over unused funds, while others will require you to spend the entire amount within a set time frame. Monitoring your balance ensures that you don’t leave any unused benefits on the table.

Plan Your Purchases: To maximize your allowance, it’s a good idea to plan your purchases ahead of time. Consider your healthcare needs for the upcoming months and make a list of items you’ll need. This way, you can stock up on essential items like pain relievers, cold medicine, or vitamins and avoid making last-minute purchases that may not be covered.

Combine with Other Benefits: If you have additional benefits such as a prescription drug plan or a wellness program, you may be able to use your OTC allowance in conjunction with those benefits. For example, if you take prescription medications, you might use your OTC allowance to purchase vitamins or supplements that complement your treatment plan.

Conclusion

The OTC allowance is a valuable and often underutilized benefit in many Medicare Advantage plans. By understanding what’s covered, knowing where to shop, and planning your purchases strategically, you can make the most of this benefit. Properly managing your OTC allowance can help you stay healthy and reduce out-of-pocket costs for everyday healthcare products. For more information on how to use your Medicare Advantage OTC allowance, consult your plan’s guide or speak with a licensed insurance agent.

I'm here to help you navigate your options and find the right plan for your needs. Call me at 440-622-2112 today for a free consultation.

Send a Message MedStar Insurance Agency

MedStar Insurance Agency